Navigating the Complexities of M&A Due Diligence for Optimal Deal Execution

April 10, 2025 · 3 mins

With an economic and corporate landscape evolving faster than ever, the due diligence process in an M&A transaction requires a thoughtful and strategic approach to ensure deal success. It’s crucial for buyers and sellers to have a clear understanding of its key components:

- Financial Due Diligence – A deep analysis of the target’s financial statements to assess cash flows, profitability drivers, recurring and non-recurring expenses, key performance indicators (KPIs), and working capital management. It also ensures the accuracy of the reported revenues, expenses and profits to help identify potential risks and determine the target’s true financial health and value.

- Operational Due Diligence – A detailed review of the target’s operations including supply chain dynamics, company-specific processes, chain of command, and day-to-day activities. The goal is to assess the business efficiency, risks and scalability, while finding areas where buyers can add value.

- Commercial Due Diligence – Analyzes the company’s market position, competition, customers, revenues streams, value proposition, and overall business model. It’s a crucial step for buyers to understand if the target aligns with their long-term strategic goals and to forecast post-acquisition performance.

- Legal Due Diligence – Involves reviewing contracts, agreements, regulatory compliance, litigation history, potential employment and labor issues, and evaluating intellectual property. The goal is to mitigate future liabilities and ensure a smooth and legally sound transaction.

Changing Landscape of Due Diligence

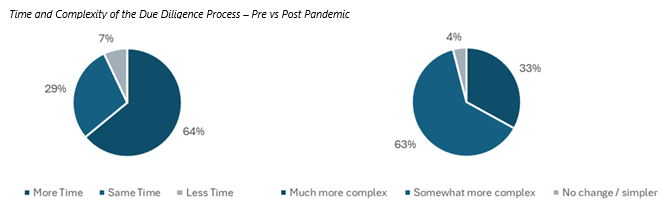

Having the majority of this information covered early in the Confidential Information Memorandum (CIM) may help mitigate future roadblocks, but even with a thorough preparation, due diligence can be unpredictable. In fact, buyers are spending more time than ever on due diligence since the pandemic.

Source : https://www.srsacquiom.com/our-insights/due-diligence-process-ma-advisor/

The shift is primarily driven by increasingly complex transactions in terms of operations, technology, regulatory environment, and economic uncertainty. More extensive research and validation period is often required, leading to a longer process. With time being a primary “deal killer” in M&A, it’s more important than ever to adhere to a proven process to drive an efficient deal execution.

Intangible Factors Affecting the Due Diligence Process

Beyond the complexity, there are other aspects that can impact the process:

- Emotional Component – Many baby boomers are looking to transition out of their family or founder-led businesses which can add an emotional layer to the transaction. Due diligence can feel intrusive, which could lead to sellers pushing back on important disclosures required to complete the transaction. In these cases, an M&A advisor can help maintain objectivity between the parties and reduce the emotional friction during negotiations.

- Impact on Day-to-day Operations – Due diligence requires a significant time commitment and resources. If the owner or executives shift too much focus away from the business, it can lead to a decrease in results and impact the transaction value and deal structure. Support from an M&A advisor can ensures business continuity during the process.

- Coordination of Tasks – There are several parties involved in the due diligence process – lawyers, accountants, bankers, advisors – making the coordination of tasks a challenge. An M&A advisor is there to quarterback the transaction and coordinate an efficient flow of information between all parties.

When considering the above, it’s clear why having a strong support team – M&A advisor, banker, lawyer, accountant, wealth manager – is crucial for a successful M&A transaction.

Patrik Landry

patrik.landry@confederationgroup.ca